Official income tax receipts (T2202) for eligible tuition and education amounts are made available by the end of February.

Tax receipts must be downloaded, printed or saved to your files through your account on mySaskPolytech.

To save and/or print your T2202

1. Sign in to mySaskPolytech. The home page will be displayed. In the upper right corner, click the "View all cards" button.

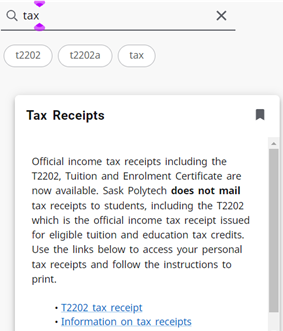

2. In the search bar type in “tax” and press enter to search. It will bring up a Tax Receipts card. In the Tax Receipts card, select the T2202 tax receipt link.

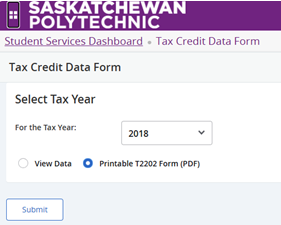

3. Select the tax year using the drop-down menu and select Printable T2202 Form (PDF).

Follow your device’s instructions to download, print or save to your files.

Calculating the amounts on your T2202

- Fees are calculated by calendar year from January 1 to December 31.

- Tuition for courses that start in one calendar year and end in the next is pro-rated between the two years.

- The tuition amount does not include books, student association fees, Health and Dental Plan or printed materials.

- The months indicated on the T2202 are for each whole or part month in the calendar year you were enrolled as a full-time or part-time student.

- For part-time status, you must attend at least three consecutive weeks for at least 12 hours of instruction per month to receive a T2202.

- For full-time status, you must attend at least three consecutive weeks for at least 15 hours of instruction per week to receive a T2202.

Your Social Insurance Number (SIN) is required

The Canada Revenue Agency (CRA) requires all designated educational institutions to report each student’s Social Insurance Number (SIN) on the T2202 Tuition and Enrolment Certificate. If you do not yet have one, apply for a SIN through the Canada Revenue Agency. To prevent delay and ensure eligibility for qualifying benefits, have your SIN submitted by February 1.

To provide your SIN, log into mySaskPolytech and enter your SIN using the SIN update link in the Enrolment Services box. You may also submit a Change of Legal Name or Social Insurance Number (pdf) form if you need to update your information.

Saskatchewan Graduate Retention Program

The provincial government Graduate Retention Program (GRP) provides a rebate up to $20,000 of tuition fees paid by eligible graduates who live in Saskatchewan and who file a Saskatchewan income tax return.

If Saskatchewan Polytechnic has your SIN by February 1, it applies to GRP on your behalf as a graduate of an eligible program. The provincial government may follow up and contact you by email. If your SIN is not provided by February 1, you must apply on your own behalf.

Frequently asked questions (FAQs)

Saskatchewan Polytechnic does not issue T2202 certificates for apprenticeship or Saskatchewan (regional) college training. Please contact either the Saskatchewan Apprenticeship and Trade Certification Commission or the college you attended.

What is a T2202?

The T2202 is an official income tax receipt issued by qualifying educational institutions for tax credits that may be claimed on a personal income tax return.

Please contact your accountant or CRA for questions regarding submission of your T2202 form.

Why is my Social Insurance Number (SIN) Required?

The Canada Revenue Agency (CRA) now requires all designated educational institutions to report each student’s Social Insurance Number (SIN) on the T2202.

Saskatchewan Polytechnic contacts all students eligible to receive a T2202 and request the SIN.

To submit your Social Insurance Number, use our secure online form available on mySaskPolytech. Follow the link on the Student Home page, under the Enrolment Services heading, “SIN Updates” or complete a Change of Legal Name or Social Insurance Number form (pdf).

If you receive any communications containing a direct link to the SIN form, delete the message. Do not click the link, do not open attachments, and do not reply to the message.

International students who have earned income in Canada and are filing a Canadian tax return must also provide the SIN. Consult the Canada Revenue Agency site for more information concerning tax obligations.

If your Social Insurance Number (SIN) is provided to us before February 1, Saskatchewan Polytechnic applies to the Graduate Retention Program on your behalf. If your SIN is not provided by February 1, you must apply on your own behalf for eligible programs. The ministry may contact you by email.

For more information, see Saskatchewan Graduate Retention Program.

An amended T2202 will be available the following Thursday if a SIN is provided after the initial T2202 release date.

Who issues my T2202?

The institution in which you paid your tuition will issue your T2202. In general, Saskatchewan Polytechnic does not issue T2202 certificates for apprenticeship, Collaborative Nursing, SCBScN or Saskatchewan (regional) college training unless tuition has been paid directly to Saskatchewan Polytechnic. Please contact either the Saskatchewan Apprenticeship and Trade Certification Commission or the college/institute you attended.

When can I get my T2202?

T2202’s are available electronically on mySaskPolytech no later than the end of February each year for the preceding taxation (e.g., calendar) year (e.g., by end of February, 2022, for the 2021 tax year).

How do I print my T2202?

Access mySaskPolytech by clicking on the mySaskPolytech link here, or by clicking the mySaskPolytech link on our home page at saskpolytech.ca.

To print your T2202 from mySaskPolytech, follow the "To save and/or print your T2202" instructions at the top of this page.

Can I print a duplicate copy of my T2202?

Yes. Second and subsequent copies include the printed word **Duplicate**.

How can I get my T2202 if I do not have a computer, printer or access to the Internet?

Saskatchewan Polytechnic libraries and other locations have computers where students can access mySaskPolytech. Other locations include, for example, Saskatchewan colleges, places of employment, community libraries, and Internet cafés.

If none of these options are available to you or you need our assistance, you may contact Enrolment Services, who will mail a copy of your T2202 to your address on record or provide to you in person (with proof of identification).

Why doesn’t the amount on my T2202 match the amount I paid for my program/course?

The total amount of tuition and fees paid may not necessarily correspond to your T2202 because not all tuition and fees are tax deductible. Also, the T2202 is based on the tax year (January to December) not the standard school year (July to June).

One of the following statements may answer your question:

- A T2202 only reports “eligible tuition fees”, not all fees that have been paid. Therefore, the T2202 will typically be less than the actual amount paid for a full-time program or course. The tuition amount does not include books, student association fees, Health and Dental Plan fees or printed materials. Refer to the Canada Revenue Agency site for eligible fees.

- Audited courses are not eligible.

- Non-credit courses are included but may not be eligible. It is the student’s responsibility to determine eligibility for taxation purposes. You may wish to consult with your accountant, or refer to the Canada Revenue Agency site.

- If the program you took started in one calendar year and ended in the next, the tuition paid will be pro-rated over the two calendar years for T2202 purposes.

- T2202 tax receipts are issued for tuition and fees paid in respect of the calendar year. If you have not paid your tuition and fees in accordance with stated Saskatchewan Polytechnic timelines, the reporting of those unpaid amounts on your T2202 will be delayed.

- Only tuition and fees greater than $100 are eligible to be reported on a T2202.

Why doesn’t the part-time/full-time months on my T2202 match my part-time/full-time status within my program?

T2202 monthly calculations are based on CRA requirements and does not reflect your full-time or part-time status at Saskatchewan Polytechnic. Part-time status on your T2202 does not mean that Saskatchewan Polytechnic considers you a part-time student.

One of the following statements may answer your question:

- Disability status: full-time or part-time status is based on Saskatchewan Polytechnic calculations. Full-time/part-time months on tax forms are subject to the same calculations for tax purposes. If you are a student with a disability, go to the CRA website for further information on tax credits and deductions for persons with disabilities or see Guide RC4064, Disability Related Information. That guide has information about services and programs that may benefit you, and deductions and credits that may apply to you.

- Students who have enrolled in a PLAR course(s) are provided a T2202 for the fees, but not calculated for months.

- For full-time status to be reported on your T2202, you must have attended for a minimum of 15 hours per week for at least three consecutive weeks. (Note: Monday is considered the first day of the week).

- For part-time status to be reported on your T2202, you must have attended for a minimum of 12 hours over at least three consecutive weeks in a single month. (Note: Monday is considered the first day of the week).

- For degree full-time status to be reported on your T2202, you must have attended for a minimum of 9 hours per week for at least three consecutive weeks. (Note: Monday is considered the first day of the week).

- The months reported on the T2202 are for each whole or part month in the calendar year you were enrolled as a full-time or part-time student.

I am a Co-operative Education student; how does that impact my T2202?

As indicated in the Canada Revenue Agency Student and Income Tax Guide , if you attend an educational institution for an academic period, then work for a similar period in a business or industry that relates to your academic studies (e.g., a work term), you are considered a full-time student only during the months that you attended the educational institution.

As a co-operative education student, you will receive an amount for tuition paid toward your work term.

Why does the system indicate I don’t have a T2202 for the tax year?

One of the following statements may answer your question:

- The course did not start in the related tax year; the T2202 is based on the study period, not on the tuition payment date.

- You took apprenticeship training and must contact the Apprenticeship Commission, or you trained at a regional college and must contact the college you attended.

- The tuition is not over $100.

- The study time is not of the required minimum length.

- A T2202 is not applicable to the following programs: GETT Camp, English as a Second Language (ESL) or Literacy and Adult Education.

What if the address on my T2202 is incorrect? Do I need a new T2202?

No. You may submit the T2202 information as received even if the address is incorrect.

To update your address, go to mySaskPolytech, Student Home page.

What if my tuition was waived, paid by a third party, or reimbursed through professional development funds?

CRA regulations generally do not permit individuals to claim educational amounts where a benefit, grant, allowance or reimbursement of tuition was received (example, dual credit high school students).

In some situations, specific to Saskatchewan Polytechnic employees (e.g., Adult Teaching and Learning program for faculty, employee development, etc.), all or part of the tuition may have been waived or reimbursed. A T2202 may still be issued in some scenarios, and it is the responsibility of employees to ensure their tax eligibility by checking CRA guidelines or by discussing the situation with an independent tax professional.

What if a third party (e.g., my parents) wants to claim the amount on my T2202?

The T2202 is always issued in the name of the student registered for classes at Saskatchewan Polytechnic. If you determine you are eligible to transfer tuition credits to a third party such as a parent, you may print the T2202 and sign the authorization on page two. Guidelines on transferring tuition credits are available from the Canada Revenue Agency.

What if I have questions about completing my income tax return or tax deductions?

Saskatchewan Polytechnic staff are not able to provide income tax advice. In-depth questions regarding the use of the T2202 in the tax preparation process should be directed to the CRA or to an independent tax professional.

Helpful CRA publications can be obtained in person at any CRA office location, by visiting the Canada Revenue Agency website, or by calling the CRA at 1-800-959-8281.

What if I still need assistance understanding the values, or I'm not in agreement with the information provided on my T2202?

Contact Enrolment Services.

Troubleshooting

T2202 won't open

Instructions for Windows systems:

- Click on the Windows home button at the bottom left of your computer screen.

- Type “pop” into the search field.

- Choose “block or allow pop-ups”, and remove the checkmark to unblock

Error message: Invalid URL

Please verify the settings.

- Tax printouts will not display if the Adobe Acrobat Reader extension is enabled.

- Use a different browser or disable the Adobe Acrobat Reader extension under the browser settings.

Error message: T2202 is not available

Please contact Regina.AR@saskpolytech.ca.

Error message: System unavailable

There was an update to your T2202 certificate. Please check back the next Thursday afternoon.

Trouble accessing account

Visit Tech Services for answers or to submit a ticket for assistance. Include your student ID number when you submit a ticket. (Your ID number is available on mySaskPolytech and on various letters, receipts, confirmations etc.)